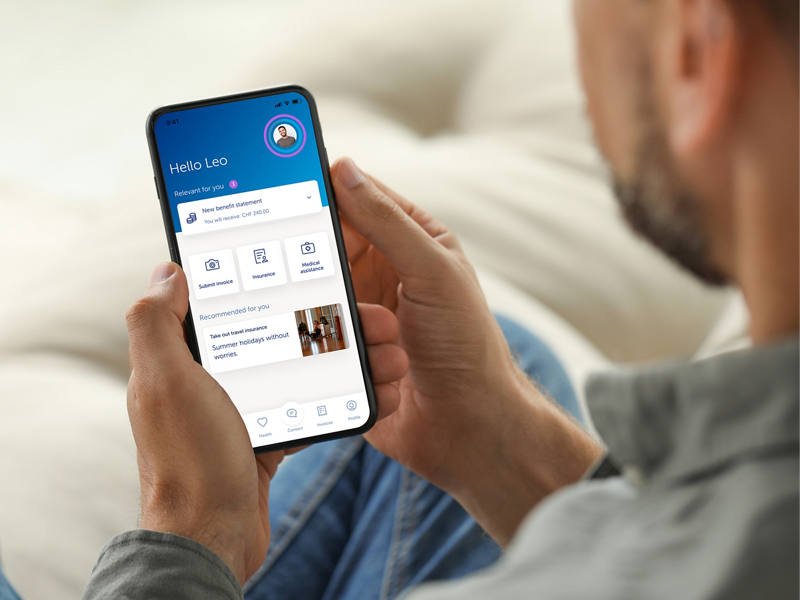

Adjust insurance

Whether you want to change your deductible, exclude accident cover or switch model: it couldn't be easier online.

Health insurance premiums at a glance

How to save on premiums

Premiums depend on where you live, your age and what deductible you choose.